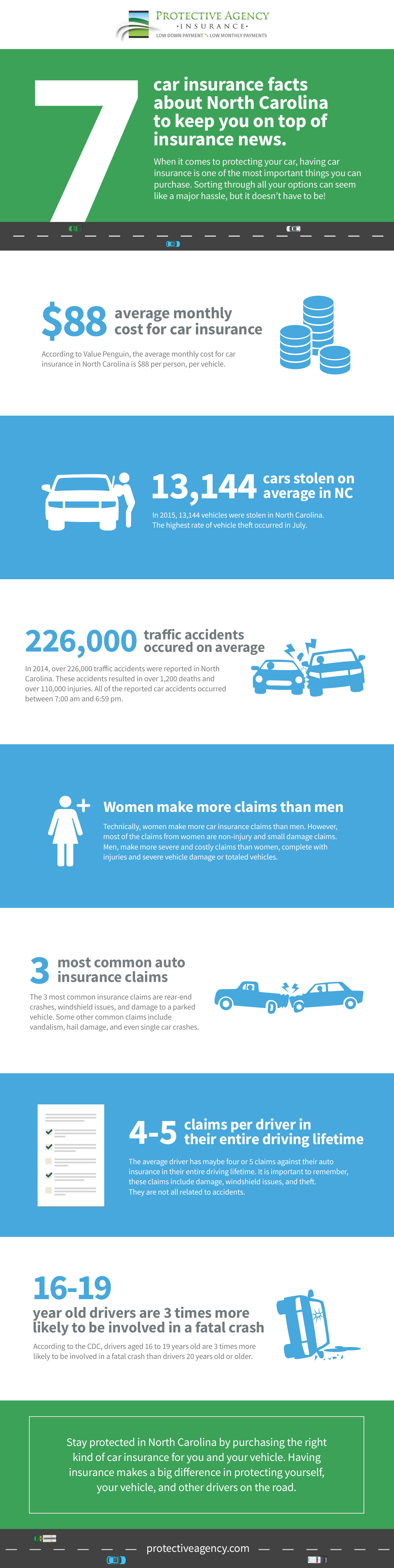

7 Car Insurance Facts About North Carolina

Thursday, May 4, 2017

When you want to help protect your car, having proper insurance in North Carolina is one of the most important things to consider. While it can be difficult to know where to start, this process is much easier by staying on top of the what’s happening in the insurance world:

$88 Per Month

According to Value Penguin, the average monthly cost for car insurance in North Carolina is $88 per person, per vehicle.

13,000 Cars Stolen

In 2015, 13,144 vehicles were stolen in North Carolina, with the highest rate of vehicle theft occurring in July.

226,000 Traffic Accidents

In 2014, over 226,000 traffic accidents were reported in North Carolina. Resulting in over 1,200 deaths and over 110,000 injuries, all of the reported car accidents occurred between 7 am and 6:59 pm.

Women Make More Claims

Technically speaking, women make more car insurance claims than men – but these are primarily non-injury and small damage claims. Men tend to make more severe and costly claims than women, including injuries and severe vehicle damage or totaled vehicles.

The Most Common Claims

The three most common insurance claims include rear-end crashes, windshield issues, and damage to a parked vehicle. Other frequent claims include vandalism, hail damage and single car crashes.

4-5 Claims per Lifetime

The average driver will make roughly 4 or 5 claims against their auto insurance during their lifetime. However, not all of these are related to accidents, with many being claims for damage, windshield issues, and theft.

16-19 Year Olds Are More at Risk

According to the CDC, drivers aged 16 to 19 years old are 3 times more likely to be involved in a fatal crash than drivers who are 20 years or older.

Contact Protective Agency today to get your car insurance quote.